We pursue high levels of customer satisfaction

through a combination of M&A and startup investment

Launched in January 2021

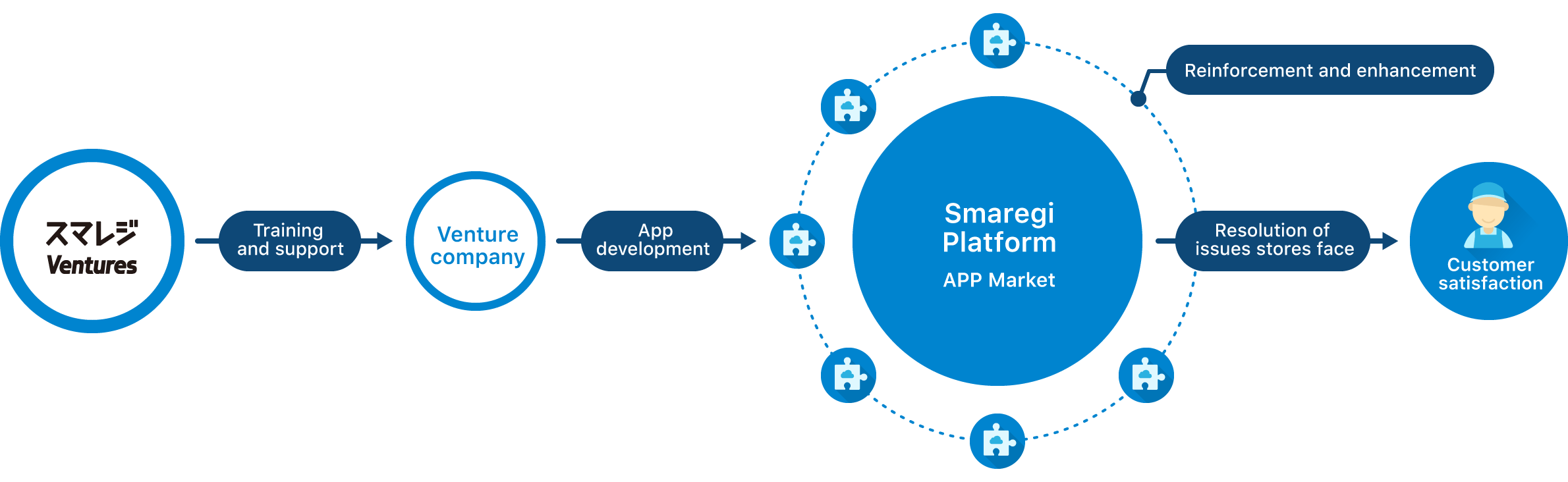

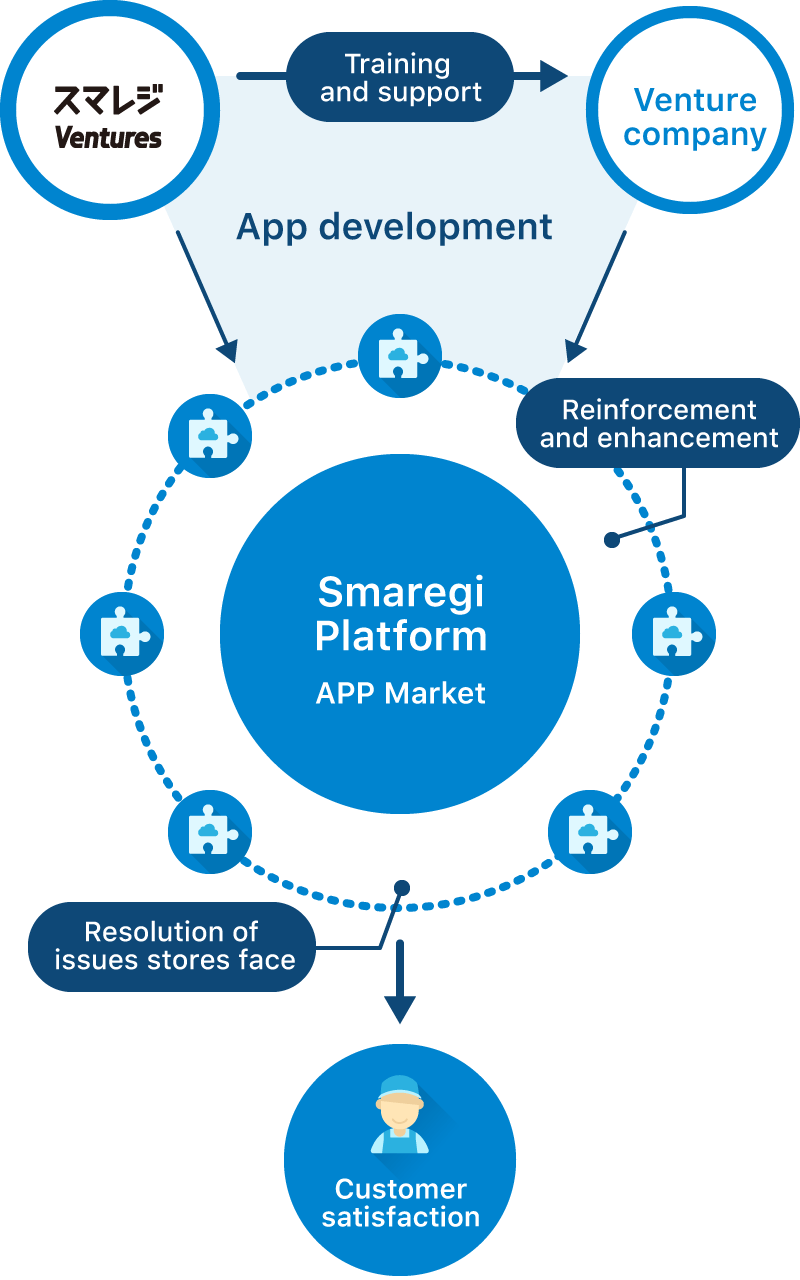

Smaregi Ventures supports business growth by engaging in investment consultations with and investments in companies that may benefit from synergies with the services Smaregi is rolling out.

Through its business, Smaregi Ventures aims to reinforce the Smaregi platform, helping to resolve the broad range of issues stores face and increase their efficiency. Smaregi Ventures is expanding its range of solutions attractive to people who use Smaregi.

Smaregi Ventures’ strengths

We lend support to investees inthrough the Smaregi Up-Tempo Program, an accelerator program. By providing Smaregi resources (such as branding, technology, personnel, and funds), we offer mentoring to help with product and business development.

Supporting growth

through expertise and funding

Smaregi’s venture capitalists contribute to business development by consulting on and conducting investment.

Fostering innovation

through massive synergies

Smaregi’s consultants facilitate business growth by supporting business development in collaboration with Smaregi.

Applying powerful resources

to accelerate business development

We approach the approximately 91,000 registered stores that have deployed Smaregi. In addition, Smaregi’s SaaS Sales team conducts proactive agency sales.

Investment Policy

| Investment objectives |

|

|---|---|

| Fields of investment |

General store-oriented solutions We invest in companies likely to generate synergies with Smaregi’s business on the IT front. At present, major target areas include store-oriented solutions. POS hardware / POS software / e-money services / change dispensers / management of store IT operations / ordering systems / inventory management / customer service support / operational support / IoT / security systems, etc. |

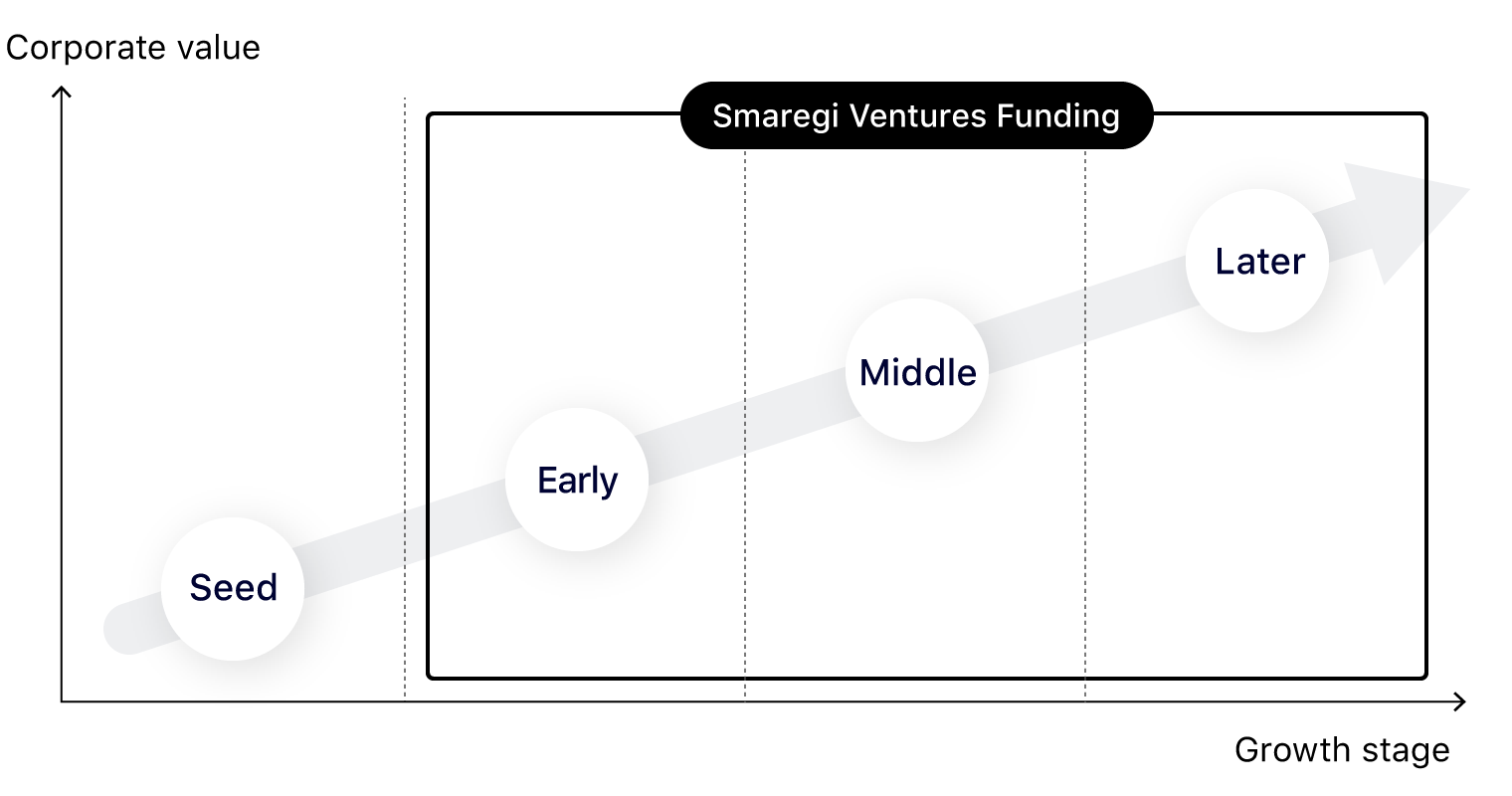

| Target investment stages |

Series A / Series B / later-stage Investments target Series A, Series B, and later-stage startups likely to create business synergies with Smaregi. We provide the necessary funding to plan, launch, and expand businesses.

|

| Investment activity areas / investment amounts |

|

Investment Process

- Step.1

- Cultivate investees

- Step.2

- Conduct surveys and analyses

- Step.3

- Determine investment conditions

- Step.4

- Hold investment committee review

- Step.5

- Conduct investment We provide ongoing training and support through the Smaregi Up-Tempo Program.